In-depth analysis of the June 2025 non-agricultural report: "false fire" cannot hide employment concerns

- 2025年7月8日

- Posted by: Macro

- Category: News

1. Non-agricultural Summary

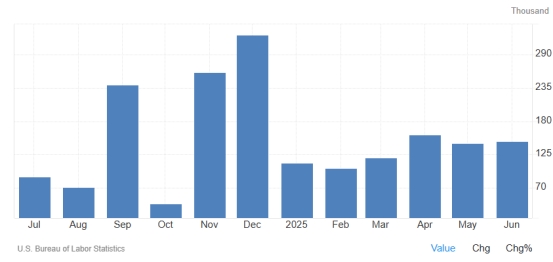

The US non-farm payrolls data for June 2025 exceeded expectations on the surface but was structurally weak, with 147,000 new jobs (expected 110,000, revised to 144,000 before), the unemployment rate dropped to 4.1% (expected 4.3%), and wages increased by 3.7% year-on-year (expected 3.8%). Despite the strong headline data, the private sector only added 74,000 jobs, the lowest level since October 2024, and the government sector contributed nearly half of the new jobs (73,000), mainly concentrated in state and local education.

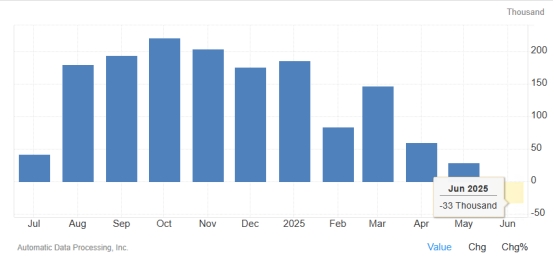

2. Interpretation of Small Non-farm ADP and Large Non-farm

In June, the number of small non-farm ADP jobs unexpectedly decreased by 33,000 (expected to be +98,000), the largest drop since March 2023, and the service industry employment suffered the largest contraction since the epidemic. The difference between this and the large non-farm is mainly due to the expansion of the government sector (such as a surge in state/local education jobs) and differences in statistical methods: ADP only covers the private sector, while the large non-farm includes government employment and household surveys show a decline in the unemployment rate.

Unemployment rate trend: The adjusted unemployment rate rose from 4.011% to 4.261% from January to June, indicating that the job market cushion is gradually thinning.

Non-farm employment revisions: Non-farm data for April and May were revised up by a total of 16,000, indicating that the resilience of the labor market was underestimated.

Wage growth slowed down: The year-on-year wage growth rate in June hit a new low since July 2024, reflecting a marginal easing of inflationary pressure.

Huatai Securities: Non-farm payrolls in June exceeded expectations but private sector employment slowed significantly. We maintain our judgment that the Federal Reserve will make two preventive rate cuts from September to December.

CITIC Securities: The employment market has limited "buffer", and an interest rate cut is expected at the September interest rate meeting.

CICC: The resilience of non-farm data does not support an early interest rate cut, and the next interest rate cut may be postponed to the fourth quarter.

Federal Reserve official Bostic: It is appropriate to wait and see at this time, and the lagged impact of tariffs on inflation needs to be assessed.

"New Fed News Agency" Timiraos: Non-farm data reinforces the wait-and-see stance, and the probability of a rate cut in July is only 5.2%.

5. Reminder of the big non-agricultural transaction in June 2025

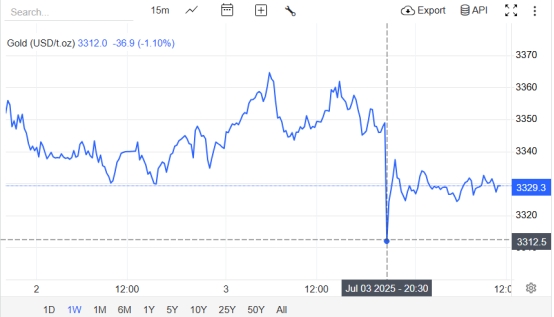

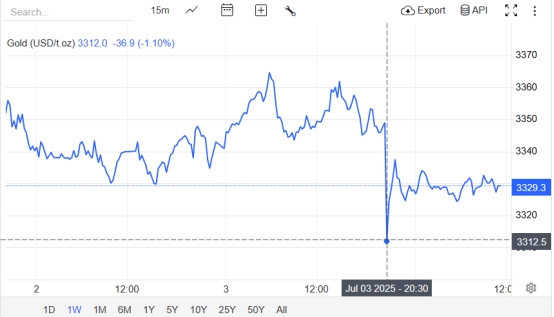

Spot Gold:

Strategy: For details, please see the column: "Exclusive Views"

Logic: Non-farm data suppresses expectations of rate cuts, and the strengthening of the US dollar suppresses gold prices in the short term; technically, the daily closing price fell below the 21-day moving average, and the hourly level is bearish.

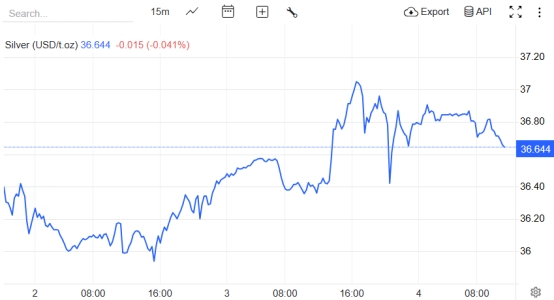

Spot Silver:

Strategy: For details, please see the column: "Exclusive Views"

Logic: After the non-farm payrolls, silver recovered some of its losses, the 20-day moving average support was effective, and the hourly level broke through the oscillation range.

Tariff policy: The United States has imposed a 50% tariff on steel and aluminum products since June 23, which may push up manufacturing costs and consumer prices, exacerbating inflationary pressure. Pay attention to the June CPI data released on July 15 (the overall month-on-month increase is expected to be 0.33%, and the core is expected to be 0.42%).

Geopolitics: The situation in the Middle East has eased somewhat due to the resumption of US-Iran nuclear talks, but the ongoing conflict between Palestine and Israel (more than 57,000 deaths in the Gaza Strip) still poses potential risks.

Federal Reserve policy trends: The June meeting kept interest rates unchanged, and the market focused on the assessment of the impact of tariffs at the July 29-30 interest rate meeting.

U.S. Treasury yields: The 10-year U.S. Treasury yield climbed to 4.25%, which will suppress the attractiveness of interest-free assets such as gold in the short term, but in the long term, we need to pay attention to the lagged impact of "normalization of high interest rates" on the economy.

Market closed: Due to the U.S. event "Earth Strikes Back", the gold and foreign exchange markets closed early at 1:00 a.m. on July 5. Please pay attention to liquidity changes.

Risk warning: The apparent strength of non-farm data may mask structural problems in the job market, and the uncertainty of geopolitical and tariff policies may exacerbate market volatility. Investors need to adjust their positions dynamically based on their own risk tolerance.