June CPI data released today: Tariff impact and interest rate cut expectations game, gold market holds its breath

- 2025年7月16日

- Posted by: Macro

- Category: News

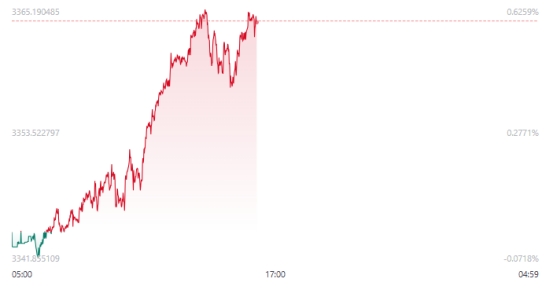

As of the early Asian session on July 15, the spot gold price was reported at $3,345.22 per ounce, down nearly $30 from yesterday's high of $3,374.78. The market is looking forward to the US June CPI data to be released at 20:30 in the evening. This data will be a key node to verify whether Trump's tariff policy has actually pushed up inflation, and will directly affect the market's expectations for the Fed's September rate cut. According to authoritative forecasts, the overall CPI in June may increase by 2.7% year-on-year, and the core CPI may climb to 3.0%, a six-month high.

The 30% tariffs imposed by the Trump administration on the EU, Mexico and other countries since April have theoretically been transmitted to the consumer end through the supply chain. Nomura Global Macro Research Director Su Bowen pointed out that although companies have buffered the impact of tariffs by hoarding inventory in the early stage, with the start of the restocking cycle in June, the rising cost of imported goods will gradually be reflected in prices. Data shows that the US manufacturing PMI price index rose to 58.2 in June, an 8-month high, and the prices of tariff-sensitive goods such as clothing and auto parts rose by more than 1.5% month-on-month.

2. How does CPI data influence expectations of a rate cut in September?

Current federal funds rate futures show that the market's expected probability of a rate cut in September has dropped to 48%, down 12 percentage points from last week. If the June CPI meets or exceeds expectations, it may further strengthen the Fed's stance of maintaining high interest rates. Nomura predicts that if the core CPI exceeds 3.0% year-on-year, the Fed may postpone the first rate cut to December, reducing the annual rate cut to 25 basis points.

On the contrary, if the CPI data is lower than expected, it may rekindle the hope of interest rate cuts. Wells Fargo analysis pointed out that if the core CPI only rises by 0.2% month-on-month, the market may bet on a 50 basis point interest rate cut in September, pushing the US dollar index back below 97.5. It is worth noting that the Trump administration has recently put pressure on the Federal Reserve and even threatened to replace Powell on the grounds of cost overruns in the renovation of the headquarters building. This political intervention may amplify market volatility after the data is released.

3. Gold market: key game under the interweaving of long and short factors

The short-term trend of gold is highly correlated with CPI data. Technically, gold prices are facing strong resistance around $3,375. If strong CPI data causes the US dollar index to break through 98.5, gold prices may fall to the $3,320 support level. On the contrary, if weak CPI leads to rising expectations of interest rate cuts, gold prices are expected to rise to the $3,380 resistance level.

IV. Historical Experience Reference

According to historical data, for every 0.1 percentage point increase in CPI year-on-year, the daily volatility of gold increased by an average of 1.2%. For example, when CPI rose by 5.4% year-on-year in June 2023, the daily volatility of gold prices reached $42.

However, we need to be alert to the risk of policy shift. If the Fed sends a dovish signal after the release of CPI data, or Trump announces a suspension of tariffs, gold may face a pullback of $50-80. Citi warned that the current gold price has partially overdrawn the expectation of interest rate cuts. If the September interest rate cut fails, it may trigger long profit-taking.

The June CPI data will serve as a "stress test" to verify the impact of tariffs. Its results will not only determine the policy path of the Federal Reserve, but will also reshape the long and short patterns of the gold market.