The unexpected negative value of ADP tore open the cracks in the job market, and gold waited for direction on the eve of non-farm payrolls

- 2025年7月4日

- Posted by: Macro

- Category: News

The unexpected negative value of ADP tore open the cracks in the job market, and gold waited for direction on the eve of non-farm payrolls

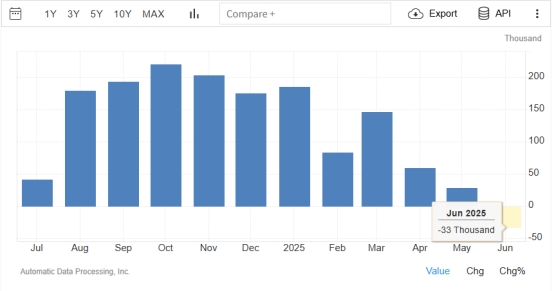

The U.S. ADP employment data for June released on July 2 recorded a rare -33,000, which not only broke the market's expectation of a "small non-farm" increase of 98,000, but also exposed the structural cracks in the job market. Detailed data show that this employment contraction is not a comprehensive recession, but rather an extreme differentiation of "hot manufacturing and cold service industries":

The commodity production industry expanded against the trend: the manufacturing industry added 32,000 jobs, of which durable goods manufacturing contributed 18,000, reflecting the resilience of the U.S. domestic manufacturing industry under the protection of trade tariffs. Although the ISM manufacturing PMI continued to shrink, the decline in the new orders index narrowed to 46.4, and companies' demand for replenishing inventory supported short-term employment.

The service industry has become the hardest hit area: education and medical care (-52,000), professional business services (-56,000), and finance (-14,000) laid off a total of 122,000 employees, the largest monthly decline since May 2020. JPMorgan Chase analysis pointed out that the decline in employment in the service industry coincides with the "cost reduction and efficiency improvement" cycle of enterprises. The wave of layoffs in industries such as technology and consulting has continued from the beginning of the year to the middle of the year, and the slowdown in consumer spending on non-essential services (core PCE service inflation fell to 3.1% year-on-year in June) further suppressed labor demand.

This divergence has triggered controversy among institutions over the resilience of the economy: Goldman Sachs believes that the support of the manufacturing industry shows that the economy has not entered a recession, and the negative ADP value may be a "temporary fluctuation"; while Nomura Securities emphasizes that the service industry accounts for 80% of US employment, and its continued contraction may be transmitted to the consumer end, exacerbating the risk of economic downturn. The market's pricing of this controversy is directly reflected in the volatility of gold - the weakness of the service industry strengthens the demand for safe-haven assets, and the resilience of the manufacturing industry suppresses excessive pursuit, causing the gold price to be caught in a tug-of-war near $3,350.

From a historical perspective, ADP also recorded a negative value (-15,000) in March 2023, and then gold rose 3.2% in two weeks; the current background is more complicated: the US dollar index fell to 96.69 (4.2 points lower than in March 2023), and the 10-year US Treasury bond yield was 4.234% (0.8 points higher than then). This combination of "weak dollar + strong US Treasury bonds" makes gold supported by the currency of denomination while being suppressed by real interest rates. This is also the core reason why the gold price did not show a unilateral trend after ADP.

Market expectations for June non-farm payrolls data diverge widely:

Optimistic scenario: If new employment exceeds expectations (for example, higher than 150,000) and the unemployment rate stabilizes, the timing of the Fed's interest rate cut may be delayed, and the rebound of the US dollar may suppress gold's short-term performance.

Pessimistic scenario: If the number of new jobs is less than 100,000 and the unemployment rate rises to above 4.5%, expectations of interest rate cuts will rise sharply, and gold is expected to break through the resistance level of $3,373.50 (61.8% Fibonacci retracement bit) and move towards the round number of $3,400.

Market Sentiment Tracking:

A Bloomberg survey shows that 11 out of 23 investment banks are bearish on non-farm payrolls (expected new additions 130,000), and 4 are neutral, reflecting intensifying differences among institutions.

Options market data shows that the implied volatility of call options near $3,350 for gold is 2.3 percentage points higher than that of put options, indicating that bullish sentiment is slightly dominant but not overwhelming.

3. Risk Warning

Risk of policy reinterpretation: Federal Reserve officials have made intensive statements recently. If the non-farm data diverges from ADP, Powell’s “data-dependent” wording may be reinterpreted, causing the market to revise its expectations for the path of interest rate cuts.

Liquidity shock: 30 minutes before and after the release of non-agricultural data, gold volatility usually rises to more than three times the daily level, so we need to be alert to short-term slippage risks.

Geopolitical linkage risks: If the situation in the Middle East (such as the Houthi armed forces attacking Israel again) resonates with the non-farm data, it may amplify the volatility of gold.

The cracks in the job market torn by the negative ADP value have put gold in a game of "economic resilience and downside risks". The release of non-farm data tonight may be the key to breaking this balance - if the data confirms that the job market is weakening across the board, gold is expected to break through $3,370; if it shows resilience, the probability of a pullback to the $3,325 support level will increase.