The Senate narrowly passed the "Big and Beautiful" bill, and the $3.3 trillion debt bomb set off a battle in the House of Representatives

- 2025年7月3日

- Posted by: Macro

- Category: News

On July 1, local time, the U.S. Senate passed the "big and beautiful" tax and spending bill pushed by Trump with a narrow margin of 51 to 50. Vice President Pham cast the key tie-breaking vote to break the deadlock. The bill plans to cut taxes by $4 trillion and raise the debt ceiling by $5 trillion over ten years, but the latest assessment by the Congressional Budget Office (CBO) shows that the Senate version will increase the federal deficit by $3.3 trillion over the next decade, far exceeding the version previously passed by the House of Representatives. The bill has aroused strong opposition from the Democratic Party due to its drastic cuts in social welfare, cancellation of new energy subsidies and expansion of military spending. The House of Representatives will start a debate on July 2. At least six Republican members have threatened to vote against it, and the legislative game has entered a white-hot stage.

The "Big and Beautiful" bill passed the House of Representatives by one vote on May 22, and then went through a 27-hour marathon vote on amendments in the Senate. Although Trump requested that it be signed into law before July 4, the Senate's amendments forced it to return to the House of Representatives for a re-vote. According to CBO data, the bill will increase the number of people without health insurance by 11.8 million in 2034 and increase the federal debt to over $36.2 trillion. In order to pass the bill, the Republicans were forced to abandon restrictions on tax deductions for workers' tips and overtime pay, and adjust Medicaid provisions, but they still failed to bridge the differences within the party - three Republican senators voted against it due to concerns about debt risks.

The core controversy of the bill lies in fiscal sustainability. CBO pointed out that while the bill stimulates economic growth through tax cuts, it will lead to rising interest rates and an additional $441 billion in interest payments. The actual increase in the deficit far exceeds the "$500 billion savings" claimed by the Republicans. The Democrats accused the bill of "robbing the poor to help the rich", saying that the average annual income of the richest families will increase by $12,000, while the poorest families will lose about $1,600 a year. Tesla CEO Musk even denounced the bill as "crazy and destructive", warning that it would "destroy millions of jobs."

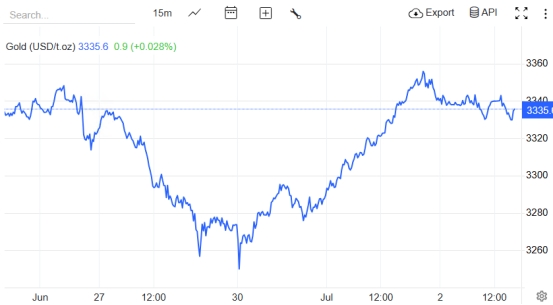

After the bill was passed, market concerns about the US fiscal deficit quickly intensified. On July 1, the US dollar index fell below 96.50, hitting a new low since February 2022; the 10-year US Treasury yield rose 4.1 basis points to 4.267%, reflecting investors' pricing of debt risks. At the same time, the spot gold price strongly broke through the $3,350 mark, reaching a high of $3,354.8 per ounce, a single-day increase of 1.17%.

House Speaker Johnson has promised to complete the vote before July 4, but the Senate version of the bill faces multiple challenges. At least six Republican lawmakers have expressed opposition, including Kentucky Congressman Massie, who bluntly stated that "the increase in debt of $3 trillion is unacceptable." In addition, the bill cancels the Biden administration's new energy tax credits, which may weaken the Republican Party's support in swing states. The Democratic Party plans to use "cutting Medicaid" and "increasing the gap between the rich and the poor" as weapons to attack the Republican Party in the midterm elections.

Although Trump has put pressure on the House of Representatives to speed up legislation, the market is skeptical about the timetable for the final implementation of the bill. White House economic advisers hinted that the signing date may be postponed to after July 4, and if the bill is blocked again in the House of Representatives, it may trigger the risk of a government shutdown.

4. Global Impact: Debt Risk and Geopolitical Resonance

The passage of the bill has heightened international concerns about the sustainability of U.S. debt. Major U.S. debt holders such as China and Japan have reduced their holdings of government bonds by more than $120 billion in the first half of 2025, turning to safe-haven assets such as gold. Data from the World Gold Council shows that global central bank gold purchases increased by 37% year-on-year in the second quarter of 2025, a record high for the same period in history.

In terms of geopolitics, the bill's expanded military spending ($150 billion) could exacerbate regional tensions. Iran threatened to "take reciprocal actions" after the bill was passed, while the cost of shipping insurance in the Strait of Hormuz still increased by 280% year-on-year, further boosting market risk aversion.

The passage of the "Big and Beautiful" bill marks a phased victory for Trump's economic agenda, but the fiscal deficit and social division it has caused may become long-term hidden dangers. The gold market is facing structural opportunities amid the interweaving of debt risks and policy uncertainties.