-

Will the Fed's delicate balance be broken? The tug of war between interest rate adjustment and new government policy !

- 2025年1月8日

- Posted by: Macro

- Category: News

No message yet

On the global financial stage, the U.S. monetary policy and financing market dynamics are a barometer of the global economy and play a vital role in the stability and predictability of global financial markets. As 2024 draws to a close and 2025 approaches, market participants are nervously watching key interest rate changes in the U.S. overnight financing market and how the Federal Reserve can maintain the consistency and independence of its policies amid the uncertainty of the new administration's policies. These changes not only foreshadow the short-term direction of the U.S. economy, but may also have a profound impact on the global economy.

-

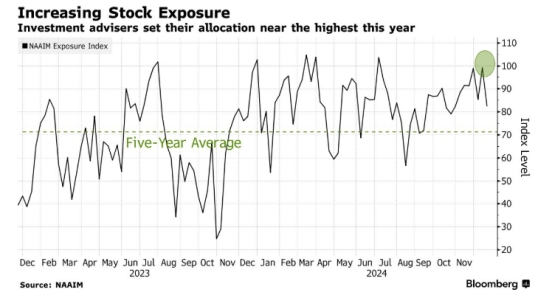

Revealing the meaning behind the " US stock Christmas rally " - potential " five major trends "

- 2025年1月6日

- Posted by: Macro

- Category: News

There is a well-known phenomenon in the US stock market, the "Christmas Rally", a seasonal trend that brings optimistic returns to investors in most years. In 2024, the development of artificial intelligence technology drove the stock market to one of its best annual performances in two thousand years !

-

[MACRO Critical Review ] Gold price shock and AI revolution: new trends in financial markets

- 2025年1月6日

- Posted by: Macro

- Category: News

Financial markets have experienced significant volatility recently, particularly in the area of gold prices and artificial intelligence (AI) investments. The price of gold was once close to a high of US$2,800 per ounce, then fell to around US$2,567 per ounce after the election. It has rebounded recently, back to US$2,600-2,700 per ounce. Such fluctuations not only reflect changes in market sentiment, but also hint at deeper economic and political factors.

-

The Fed turns to the " Trump deal " - the outlook for gold and the dollar amid market volatility

- 2025年1月2日

- Posted by: Macro

- Category: News

A month ago, the hot topics in the market focused on Trump and his U.S. economic blueprint for boosting economic growth next year and beyond. However, as the Christmas holiday approaches, the hawkish shift of Federal Reserve Chairman Powell has once again become the focus of the market, bringing inflation back into the investors' sight and triggering the biggest market turmoil since Election Day.

-

The market reacted strongly to the Fed’s third rate cut, and expectations for future rate cuts showed negative growth!

- 2025年1月2日

- Posted by: Macro

- Category: News

-

Fed may adjust rate cut expectations in response to productivity growth and economic data

- 2025年1月2日

- Posted by: Macro

- Category: News

-

Introduction to Macro Global Markets

- 2025年1月2日

- Posted by: Macro

- Category: News