The impact of tariffs is beginning to emerge: the US CPI in June rebounded more than expected year-on-year, and gold fell under pressure

- 2025年7月18日

- Posted by: Macro

- Category: News

The impact of tariffs is beginning to emerge: the US CPI in June rebounded more than expected year-on-year, and gold fell under pressure

1. Rising prices of imported goods: Affected by the US's additional tariffs on the EU, Indonesia and other countries, furniture prices rose 1% month-on-month in June, toy prices rose 1.8%, and clothing and footwear prices rose simultaneously. The Associated Press analysis pointed out that this is the first time since the implementation of the tariff policy in 2024 that the inflation effect of imported goods has been significantly reflected in the CPI data.

1. Rising prices of imported goods: Affected by the US's additional tariffs on the EU, Indonesia and other countries, furniture prices rose 1% month-on-month in June, toy prices rose 1.8%, and clothing and footwear prices rose simultaneously. The Associated Press analysis pointed out that this is the first time since the implementation of the tariff policy in 2024 that the inflation effect of imported goods has been significantly reflected in the CPI data.

2. Energy prices rebounded: Energy prices rose by 0.9% month-on-month in June, reversing the previous decline of -1.0%. Among them, gasoline and fuel prices "turned from falling to rising", directly driving the CPI to increase by 0.15 percentage points month-on-month.

The EU's countermeasures are imminent. On July 14, the European Commission announced a retaliatory tariff list worth 72 billion euros (about 84 billion U.S. dollars), covering categories such as Boeing aircraft, automobiles and parts, and Bourbon whiskey. It will be submitted to the EU Council for a vote on July 16. If the US and Europe fail to reach an agreement before August 1, the countermeasures will officially take effect. French President Macron called on EU companies to suspend investment in the United States, while member states such as Ireland, which are highly dependent on US exports, advocated a cautious response, and the internal rifts of the EU further emerged. The International Monetary Fund (IMF) warned that if the US-EU trade war breaks out in full, global GDP growth may fall by 0.8%, threatening 12 million jobs.

2. Divergence in Fed policy expectations and market reactions

Monetary policy game intensifies:

Although the overall CPI exceeded expectations year-on-year, the slowdown in the month-on-month growth of the core CPI provided a buffer for the Fed to maintain the current interest rate. Federal funds rate futures show that the market expects a rate cut of about 44 basis points before the end of the year, and the probability of a rate cut in September has dropped from 80% to 53%. Fed Chairman Powell said at a congressional hearing on July 15 that "the impact of tariffs on inflation has a lag, and subsequent data needs to be observed", suggesting that interest rates will not be adjusted in the short term.

Double suppression of the US dollar and US debt:

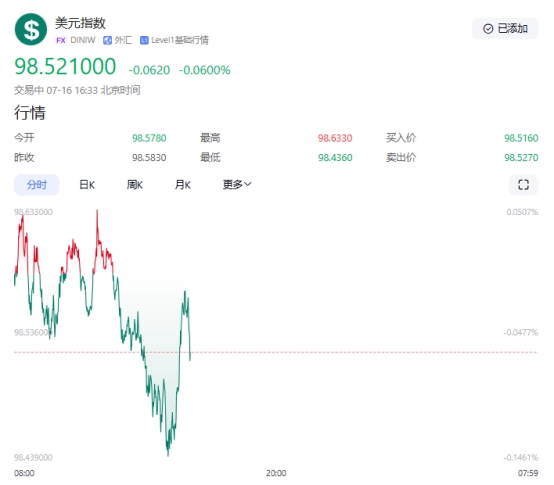

The US dollar index broke through the 50-day moving average of 98.80 and then accelerated upward, approaching the integer mark of 100. The weakening of non-US currencies indirectly suppressed the gold price. The 10-year US Treasury yield rose to 4.487% after breaking through 4.4%, reflecting the market's adjustment of inflation expectations. The break-even inflation rate rose to 2.5%, showing investors' concerns about long-term inflation. The high-yield environment weakens the attractiveness of gold as an interest-free asset, but the increase in supply chain costs caused by tariffs may provide potential support for gold prices.