[MACRO Trends] Behind the strengthening of gold: multiple drivers of fiscal risks, policy competition and market reconstruction

- 2025年7月11日

- Posted by: Macro

- Category: News

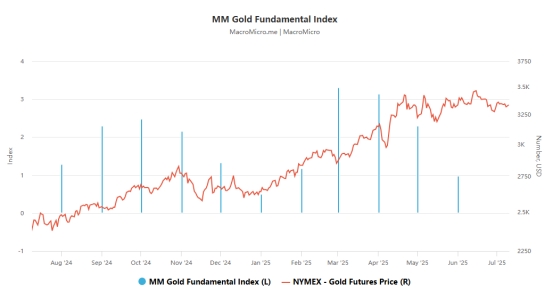

Against the backdrop of global economic and political uncertainty, gold, as a traditional safe-haven asset, is seeing a new round of attention. From the soaring fiscal deficit in the United States to the repeated fluctuations in trade policy, from the unclear interest rate path of the Federal Reserve to the continued increase in holdings by central banks around the world, multiple factors have jointly pushed gold prices to show strong resilience in a complex environment. This strengthening is not the result of a single variable, but a market picture woven together by the accumulation of fiscal risks, the increase in policy uncertainty and the reconfiguration of global capital.

The increasingly severe fiscal situation in the United States is becoming an underlying factor supporting gold prices. The World Gold Council pointed out that with the passage of the "Big, Beautiful Act", if the Trump administration fails to achieve its growth expectations, the United States will add $3.4 trillion in debt in the next decade and the debt ceiling will increase by $5 trillion, which will make the US debt of $36.2 trillion even worse. Coupled with the political atmosphere heated up by Musk's threat to establish the "American Party", the dual accumulation of fiscal and political risks has triggered a global capital reconfiguration.

The World Gold Council stressed that the loose fiscal policy of the past two decades has put the United States in a vulnerable fiscal position, and the "Big, Beautiful Act" may further amplify this risk. Although the possibility of a full-scale fiscal crisis is low, a series of "rolling mini-crises" (such as debt ceiling games and policy implementation deviations) are more likely to become the norm, and this continued uncertainty will provide long-term support for gold demand.

2. Trade frictions and policy fluctuations: catalysts for short-term market sentiment

The Trump administration's trade policy is becoming an important variable that stirs up market sentiment. Recently, the United States announced a new 50% tariff on copper imports and made it clear that "the exemption period will not be extended and retaliatory measures will be responded to by increasing taxes." This move directly triggered market concerns about the slowdown in global economic growth and accelerated the inflow of safe-haven funds into the gold market. Data shows that gold prices have rebounded from the recent low of one and a half weeks, and the short-term upward momentum is significant.

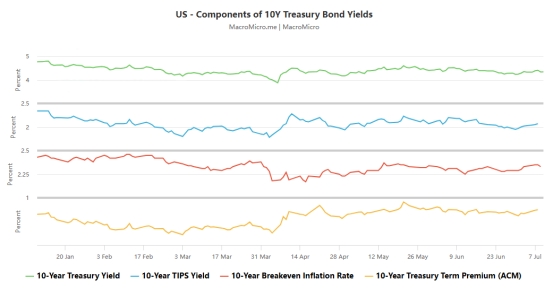

3. Fed policy and interest rate game: a new market normal with traditional logic reconstructed

The Fed's interest rate policy path has always been a key variable affecting gold prices, but since 2022, the traditional logic of "interest rates and gold prices are inversely correlated" is being broken. Although the current real interest rate in the United States has risen to more than 2%, gold prices have risen against the trend. Behind this phenomenon is the balance of multiple factors: investors' urgent need for risk relief, the continued gold purchases of global central banks, and the market's expectations of a shift in the Fed's policy. The minutes of the Fed's June meeting showed that although most officials believed that there was no need to cut interest rates immediately, it was generally expected that if tariffs pushed up inflation, interest rate cuts might be initiated within the year.

The strong employment data in June has caused some investors to reassess the necessity of rate cuts. This contradiction makes interest rate expectations full of variables. The market's bets on a rate cut in July have weakened, but the possibility of easing this year remains. This uncertainty has pushed the 10-year Treasury yield down. The strong demand for the 10-year Treasury auction in the United States on Wednesday and the sharp drop in yields have further strengthened the allocation value of gold. The World Gold Council analysis pointed out that this new normal of "interest rates and gold prices rising together" is essentially the market's pricing of "fiscal risks exceeding the impact of interest rates." When investors' concerns about the sustainability of US fiscal policy intensify, gold's safe-haven properties will outweigh the holding cost pressure brought by rising interest rates.

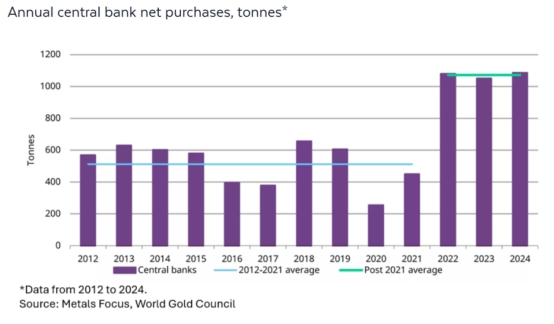

4. Central Bank Gold Purchases and Market Structure: A Historic Change on the Demand Side

From the perspective of market structure, this change in demand is of symbolic significance: the gold market, which was previously dominated by private investors, is increasingly influenced by the behavior of official institutions. Central banks in emerging markets have reduced their reliance on US dollar assets by increasing their gold holdings. This "de-dollarization" trend echoes the expansion of the US fiscal deficit, providing medium- and long-term support for gold prices.

5. Short-term fluctuations and long-term trends: Gold’s position in uncertainty

From the perspective of short-term market performance, gold price fluctuations are significantly affected by technical and emotional factors. Currently, the gold price is approaching the 100-period simple moving average (around $3,335/ounce). If it breaks through this key resistance level, it may trigger short-covering and push the gold price towards $3,400/ounce; if it falls below $3,300, it is necessary to pay attention to the support levels of $3,282 and $3,247. This volatility reflects the market's sensitive response to short-term policy signals.

Whether it is the accumulation of long-term fiscal risks or the disturbance of short-term policy games, the strengthening of gold is not only a temporary release of market sentiment, but also a re-pursuit of certainty by capital in the process of reconstructing the global economic order. This pursuit may be the key to understanding the current gold market.