【MACRO Trends】Labor market signals and gold price drivers: The dual struggle between the Federal Reserve and global capital

- 2025年7月21日

- Posted by: Macro

- Category: News

Against the backdrop of a profound adjustment in the global economic landscape, the linkage between the direction of US monetary policy and the gold market has become increasingly prominent. The fierce disagreement within the Federal Reserve on the timing of interest rate cuts, the chain reaction caused by the Trump administration's tariff policy, and the subtle changes in global capital's confidence in US dollar assets have jointly shaped the new positioning of gold as a core asset. From the central bank's gold purchase boom to the surge in market demand for risk aversion, gold is evolving from a traditional crisis hedging tool to a strategic allocation target for coping with geopolitical economic uncertainties.

Policy differences within the Federal Reserve are becoming a key variable that stirs the market. Board member Christopher Waller and Vice Chairman Michelle Bowman publicly called for a 25 basis point rate cut at the July 29-30 interest rate meeting. The core basis is that the labor market has shown signs of weakness on the "dangerous edge" - the momentum of economic growth has slowed significantly, with only 1% growth in the first half of 2025 and only 1% growth in the second half of the year. It is expected that "risks will rise and fall from the target." Waller emphasized that inflation is close to the target level of 2%, and the upside risks are limited. The impact of tariffs on inflation is only temporary, and policy making should focus on "baseline inflation" rather than short-term disturbances.

2. The chain reaction of Trump’s policies: de-dollarization and structural demand for gold

The Trump administration's global tariff policy is becoming an "invisible driver" of reshaping global capital flows. David Russell, head of global market strategy at TradeStation, pointed out that tariffs have accelerated the "de-dollarization process" - countries' dependence on the US final market and the US dollar continues to decline, and the trend of "returning to the 19th century trade model" has given rise to structural demand for gold. The central banks of the BRICS countries, especially China and India, have accelerated their gold reserves. The People's Bank of China's gold holdings have risen for eight consecutive months, becoming a core measure of the "de-dollarization strategy." The decline in the United States' own credit quality has further strengthened this trend. Moody's downgraded the United States' highest credit rating in May this year, marking the loss of the AAA rating from the three major rating agencies. The root cause is the continued expansion of the deficit and the pressure of unfunded liabilities such as social security.

3. Outlook for the gold market: Upward momentum under multiple scenarios

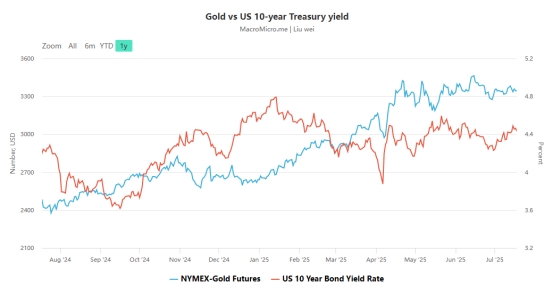

Data from the World Gold Council show that gold prices rose nearly 26% in the first half of 2025, hitting 26 all-time highs, continuing the strong momentum of a 20% increase in 2024. This performance stems from the resonance of a weaker dollar (the worst start to a year since 1973), interest rate range fluctuations and geopolitical tensions, with risks related to US trade policy contributing about 16% of the increase. Technically, the gold price held the $3,250/ounce mark in June, and the August delivery price closed at $3,359.10, showing breakthrough potential; the total holdings of global gold ETFs reached 3,616 tons, an increase of 397 tons from the beginning of the year. Although it is lower than the peak in 2020, there is still a large net space. The ability of COMEX futures to accumulate long positions also suggests that upward goods can be further accumulated.

Conclusion: Deterministic Configuration in Uncertainty

From the interest rate game of the Federal Reserve to the global wave of de-dollarization, from the weakening of US fiscal credit to the continued disturbance of geopolitics, gold is at the intersection of multiple favorable factors. The World Gold Council emphasizes that no matter how the macro environment evolves, gold is still a favorable target for tactical and strategic decision-making, supported by "a weaker US dollar, central bank gold purchases, and strong investment demand." This traditional wisdom of "hiding gold in troubled times" is being given new contemporary connotations in the context of contemporary policy uncertainty and geopolitical economic reconstruction.