The Fed data dilemma and the Euro exchange rate game: Dual variations in global monetary policy and market expectations

- 2025年6月30日

- Posted by: Macro

- Category: News

[MACRO Sharp Comments] The Fed data dilemma and the euro exchange rate game: Dual variations of global monetary policy and market expectations

These two transatlantic events seem isolated, but they actually have an economic logic: the Federal Reserve is stuck in a policy-making dilemma due to data distortion, and the foreign exchange market is pricing in potential risks to the fundamentals of the U.S. economy in advance through fluctuations in the euro exchange rate. The contradiction between the lag in policy-making and the forward-looking nature of market expectations has exposed the fragility of the global monetary policy transmission mechanism in the post-epidemic era. When traditional economic data models encounter structural changes, the central bank's "data anchor" becomes ineffective, and the speculative forces in the exchange rate market and the real needs of the real economy begin to produce intense friction.

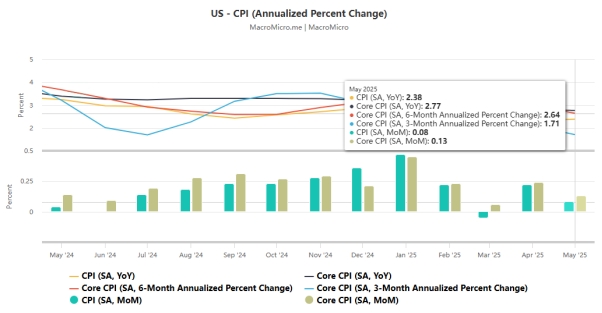

1. The Federal Reserve in the data fog: the struggle between policy caution and political pressure

Data distortion has exacerbated policy differences within the Fed. Powell adheres to the principle of "prudent adjustment", believing that although inflationary pressures are temporarily under control, the impact of tariffs on the economy is not yet clear, and a hasty rate cut may amplify policy lags. He specifically pointed out: "The uncertainty caused by tariffs provides a reason to maintain interest rates, and inflation may show a 'meaningful increase' due to trade policies." This position is in sharp contrast to Trump's radical claims - the latter has repeatedly denounced Powell on social media as "stupid and stubborn", believing that high interest rates have pushed up government borrowing costs, and even hinted that interest rate cuts must be initiated in July. However, market expectations for rate cuts have preceded policy implementation. The money market is betting that the Fed will cumulatively cut interest rates by 60 basis points by the end of 2025, while the European Central Bank will only cut interest rates by 25 basis points. This interest rate differential expectation has become a key engine driving the euro's strength.

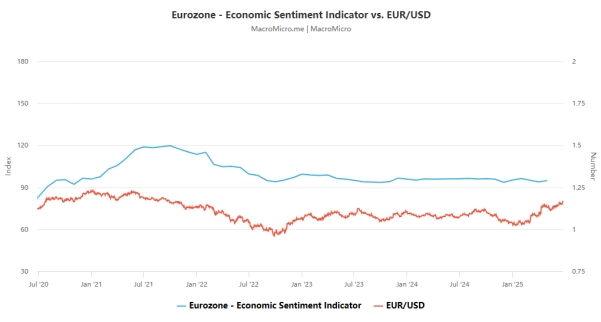

2. Battle of the Euro at 1.17: The resonance of institutional bullishness and the dollar's decline

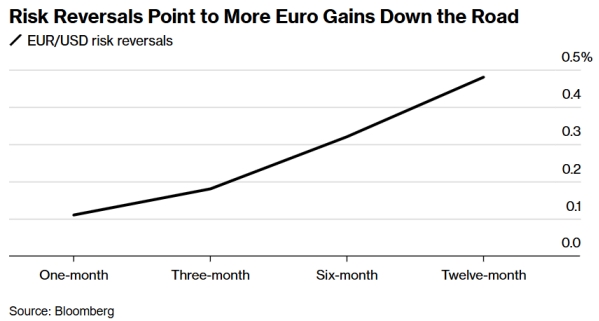

Institutional optimistic expectations for the euro have formed a combined force. HSBC strategists raised their year-end target price from 1.15 to 1.20. Danske Bank and Deutsche Bank both predicted that this level would be reached within 12 months. UBS even pointed out that "US interest rates will fall faster than other G10 countries" and expected the euro to reach 1.23 against the dollar at the end of the year. The bullish sentiment in the options market is particularly significant: the risk reversal index recorded the fourth largest single-day increase in more than three years, and the proportion of bullish contracts in euro options this month exceeded 60%, indicating the market's confidence in the continued strength of the euro. The ECB's policy narrative provides fundamental support for the euro. Chief Economist Ryan said that although price pressures remain, the process of inflation returning to the 2% target is "close to completion", which contrasts with the Fed's dilemma of still having to deal with data distortion, further strengthening the relative attractiveness of the euro.

3. The logic of global market linkage: the transmission chain from data crisis to exchange rate game

This linkage is particularly prominent in the current market: when the BLS is forced to rely on historical trends to estimate employment data due to a shortage of funds, foreign exchange traders are betting on a euro breakthrough based on the Fed's possible policy shift; when Powell emphasized "cautious rate cuts" at the hearing, the options market has voted for the euro's 1.20 target with real money. The disconnect between data quality and market expectations constitutes the core contradiction of global monetary policy in 2025.

Conclusion: Policy and market competition in an era of uncertainty