[MACRO Sharp Comments] Panoramic analysis of US non-agricultural data in June: Employment resilience and market ripples under policy games

- 2025年7月7日

- Posted by: Macro

- Category: News

The June non-farm data released by the U.S. Bureau of Labor Statistics on Thursday, like a stone thrown into the market lake, not only reflects the complex resilience of the U.S. labor market, but also triggers the financial market to re-examine the policy path of the Federal Reserve. From the employment data itself to asset price fluctuations, from the differentiation of industrial structure to the confrontation of institutional views, this report outlines the current delicate picture of the U.S. economy.

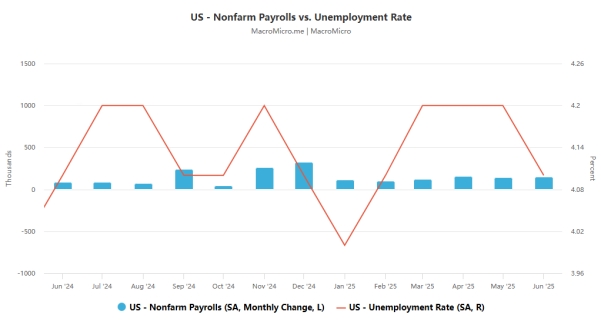

In June, non-agricultural employment increased by 147,000, which was higher than the expected 110,000. The previous value was revised up from 139,000 to 144,000, exceeding economists' forecasts for the fourth consecutive time. The unemployment rate unexpectedly fell to 4.1%, lower than the expected 4.3% and the previous value of 4.2%. It has remained stable in the narrow range of 4.0%-4.2% since May 2024.

From the survey details, the household survey data revealed a deeper structure: the number of long-term unemployed (unemployed for 27 weeks or more) increased by 190,000 to 1.6 million, accounting for 23.3% of the total number of unemployed; the labor force participation rate remained stable at 62.3%, and the employment-population ratio remained at 59.7%. It is worth noting that the number of marginal workers (those willing to work but not actively seeking employment) increased by 234,000 to 1.8 million, among which the number of "disappointed workers" (those who believe they cannot find a job) surged by 256,000 to 637,000, suggesting that there is still hidden slack in the labor market.

2. Market chain reaction: sudden changes in asset prices and policy expectations

After the data was released, financial markets quickly adjusted pricing: the U.S. dollar index rose in the short term, up 0.47% on the day to close at 97.308, hitting the 97 mark; spot gold fell by $19 in the short term, breaking below $3,320/ounce, and closed down 0.65% to $3,328.04/ounce.

III. Employment structure: Government-led growth and private sector differentiation

Institutional survey data showed that employment growth in June showed the characteristics of "strong government and weak private sector". The government sector added 73,000 jobs, of which state government education contributed 40,000 and local government education added 23,000. However, the federal government laid off 7,000 people for the fifth consecutive month, with a total of 69,000 layoffs since January.

The performance of the private sector was differentiated: the healthcare industry added 39,000 jobs, close to the average in the past 12 months; the social assistance industry increased by 19,000 jobs, mainly from personal and family services; the construction industry bucked the trend and added 15,000 jobs, the largest increase since December last year, despite high mortgage rates and a weak real estate market in the spring. However, employment in most industries such as mining, manufacturing, and retail did not change much. The private sector as a whole added 74,000 jobs, lower than the expected 100,000, and a significant drop from 137,000 in May.

Nick Timiraos, the "Fed's mouthpiece," pointed out that the report showed that the labor market's "slow hiring, slow firing" characteristics are still continuing. Jack McIntyre of Brandywine Global Investments believes that the strength of hard data (such as non-agricultural employment) proves that the Fed is right to stay on the sidelines, and market changes are flattening the yield curve, and the steepening of the curve may continue to close positions. Analyst Chris Anstey emphasized that this report does not constitute an urgent reason for the Fed to cut interest rates immediately. The Trump administration may use this to emphasize that employment has continued to exceed expectations, highlighting the economic resilience of "mild inflation and solid employment."

However, the decline in unemployment may be related to immigration policy: the number of foreign-born workers fell to 32.6 million in June, down 1.1 million from March, and fell for three consecutive months. Analyst Jonnelle Marte believes that the shrinking immigrant labor force may suppress the unemployment rate and is related to the strengthening of border control. Jeffrey Rosenberg of BlackRock, the world's largest bond fund, is cautious, believing that the growth that relies on state and local government recruitment is actually weaker than expected, and the weakness of the private sector cannot be ignored.

5. U.S. Treasury Bonds and Policy Outlook: Goldman Sachs lowers its yield forecast

Although the non-agricultural data in June eased the pressure on the Federal Reserve to cut interest rates, Goldman Sachs Group still lowered its forecast for U.S. Treasury yields in a report on July 3, predicting that the two-year and ten-year Treasury yields will be 3.45% and 4.20% respectively at the end of the year, down 0.4 and 0.3 percentage points from the previous forecast. Its strategists believe that factors such as government recruitment-led growth and a slight decline in labor participation have weakened the strength of the data, and that the Federal Reserve will have room to cut interest rates more significantly, supporting lower yields.

In summary, the June non-agricultural report not only shows the resilience of the US labor market, but also reveals structural contradictions. For the Federal Reserve, the combination of "robust employment + moderate wages" provides room for policy wait-and-see; for the market, in the game between hard data and soft expectations, short-term fluctuations and long-term trends, the future trend will be more dependent on the further evolution of inflation data and fiscal policy.