The Fed meeting minutes released divergent signals on interest rate cuts, and the gold market is looking for direction in the policy game

- 2025年7月14日

- Posted by: Macro

- Category: News

The Fed meeting minutes released divergent signals on interest rate cuts, and the gold market is looking for direction in the policy game

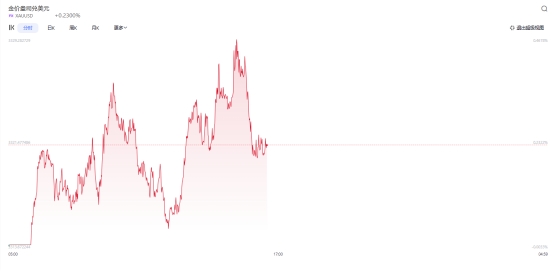

On July 9, local time, the Federal Reserve released the minutes of the Federal Open Market Committee (FOMC) meeting from June 17 to 18, showing that some officials supported considering a rate cut at the July 29-30 meeting, but most officials believed that more economic data was needed to assess the impact of tariff policies on inflation. This statement contrasted with the market's previous strong expectations for a rate cut in July, resulting in a volatile gold price pattern in the early Asian session on July 10 - London gold once surged to $3,326.16 per ounce, and then fell back to around $3,318.

The minutes showed that Fed officials had significant differences on the impact of tariff policy. Some officials believed that the tariffs imposed by the Trump administration on imported goods may push up inflation through the supply chain, but if trade negotiations make progress, this impact may be short-lived. For example, the 20%-50% tariffs on Brazil, the Philippines and other countries will take effect on August 1, which may directly push up the prices of key raw materials such as copper and transistors, and thus affect the cost of US manufacturing. However, most officials stressed that current economic data (such as non-farm employment exceeding expectations in June and the rebound in the service industry PMI) show that the US economy is still resilient, and premature interest rate cuts may weaken the Fed's policy space to deal with future risks.

It is worth noting that Fed Chairman Powell's public statement after the June meeting echoed the minutes. He pointed out that if it were not for the tariff policy, the Fed might have started a rate cut cycle, but it is currently necessary to balance trade uncertainty and inflationary pressure. This "wait and see" attitude is reflected in the minutes of the meeting - 10 of the 19 officials expect at least two rate cuts this year, but 7 believe that there is no need for a rate cut, and 2 only support a single rate cut.

3. The two-way effect of interest rate cut expectations on the gold market: short-term pressure and long-term support coexist

The gold market reaction on July 10 reflects the complexity of policy games:

Short-term suppression effect: The market's expected probability of a rate cut in July has dropped from 55% before the release of non-farm data to around 40%, causing short-term pressure on gold.

The policy divergence revealed by the Fed's meeting minutes has put the gold market in a game of short-term volatility and long-term bullishness. Although expectations for a rate cut in July have cooled, structural factors such as global trade tensions, central bank gold purchases and weakening US dollar credit still provide support for gold.