[MACRO Sharp Comments] Financial markets in the vortex of US economic policy: the triple game of debt, currency and corporate profits

- 2025年7月17日

- Posted by: Macro

- Category: News

The current US economy is at a critical juncture where multiple policy variables are intertwined: debt interest payments have broken through historical peaks, the Federal Reserve's monetary policy path is shrouded in mystery, and corporate profits are trying to find a balance between trade frictions and technological innovation. The game of these three dimensions not only affects the trend of core assets such as US stocks, US bonds, and the US dollar, but also reflects the deep contradictions between fiscal expansion, political intervention, and market rules in the US economy.

The debt problem of the U.S. federal government has entered the critical point of "quantitative change to qualitative change". At present, debt interest expenditures have exceeded federal health insurance and defense expenditures. According to the forecast of the "Committee for a Responsible Federal Budget", interest expenditures will reach 1 trillion US dollars next year, second only to social security as the largest expenditure. The core of this change lies in the "inversion" of debt costs and economic growth. Since the early 2000s, the inflation-adjusted 10-year U.S. Treasury yield has long been lower than economic growth expectations, and now both have risen to more than 2%, forming what Bernstein (former Biden economic adviser) calls a "game changer for debt sustainability."

In the face of the crisis, the policy level has fallen into politicization. Bernstein called on Congress to set up an "emergency" fiscal response mechanism, but avoided the impact of Biden's government spending and focused on Trump's policies; Trump tried to ease debt pressure by pressuring the Federal Reserve to cut interest rates. This idea of "covering fiscal imbalances with monetary easing" laid the groundwork for subsequent market fluctuations.

2. Monetary policy fog: the "expectation tug-of-war" between the Federal Reserve and the market

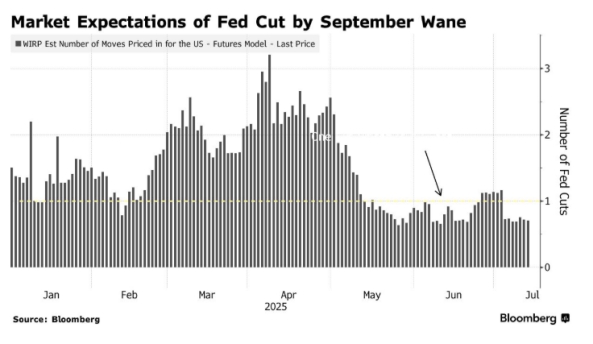

The Fed's policy path is becoming a core variable in market fluctuations. At the beginning of the year, traders were almost certain that interest rate cuts would resume in September, but strong July employment data and uncertainty about tariff policies have reduced this probability from "a sure thing" to about 70%. The June CPI data has therefore become the "decisive factor" - Barclays pointed out that the June CPI has deviated from expectations by the largest margin in history. If it shows that price pressures are heating up (especially driven by Trump's tariffs), it may completely shake expectations of interest rate cuts and push up US bond yields; if the data is mild, it may restart easing bets.

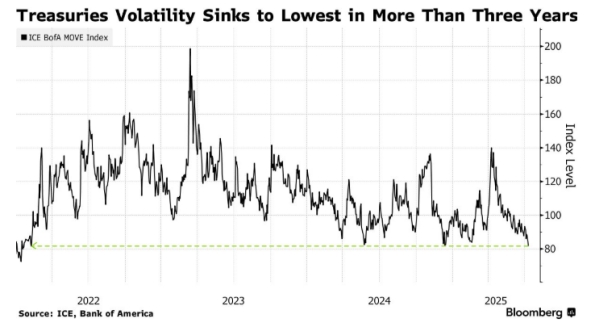

There are also differences within the Fed: Powell emphasized the "moderately restrictive" interest rate stance, and the dot plot showed that there might be two rate cuts before the end of the year, but seven officials believed that there would be no rate cuts in 2025, and Waller and other directors hinted that rate cuts would be restarted as early as this month. This disagreement, combined with political pressure, has caused the U.S. Treasury market to fluctuate within a range - the two-year yield has fluctuated between 3.7% and 4%, and volatility has dropped to a three-year low. Traders continue the short-term strategy of "buy on dips and sell on rallies."

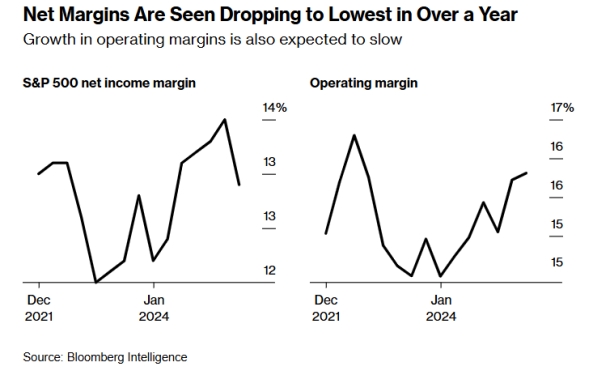

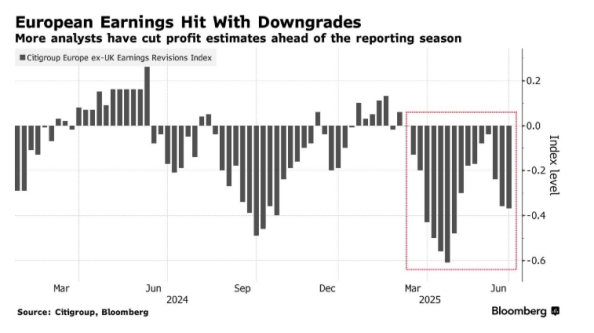

3. Corporate Profits and the Stock Market Paradox: Differentiation and Opportunities under Low Expectations

This "low expectation" has become a potential positive. Charles Schwab pointed out that the current expectation threshold is extremely low, and it is easier for companies to exceed expectations. The key lies in whether gross profit margin can withstand tariff pressure. The performance of technology giants is particularly critical: the "seven major technology giants" are expected to grow profits by 14% in the second quarter. If they are excluded, the S&P 500 profit may fall slightly by 0.1%. Despite the uncertain trade environment, Microsoft, Meta and others still plan to increase capital expenditures to US$337 billion in fiscal 2026. AI investment has become a core growth point. BlackRock believes that "AI is the most enduring dominant theme."

Conclusion: Reconstructing market logic in the policy vortex

The US financial market is experiencing "policy-driven" fluctuations: the steep upward channel of the ratio of debt interest to GDP has made interest rates the core node connecting fiscal and monetary risks. If the Federal Reserve succumbs to political pressure and cuts interest rates prematurely, it may push up long-term inflation and interest rates, exacerbating the debt burden; if it insists on fighting inflation, it will directly amplify the pressure of interest expenditures. This "double helix trap" is intertwined with the differentiation of corporate profits and the weakening of the US dollar, causing the market pricing logic to shift from "economic fundamentals driven" to "policy game driven." This game across fiscal, monetary and corporate levels is reshaping the confidence boundary of global capital in US dollar assets.